Tax & Utilities

Important Announcements

For all property tax-related inquiries, please email a copy of your photo ID to [email protected].

Did you lose your tax notice? To request a reprint of your notice, please email your information along with a copy of your photo ID to [email protected]. Please wait until May 15, 2024 before requesting a reprint.

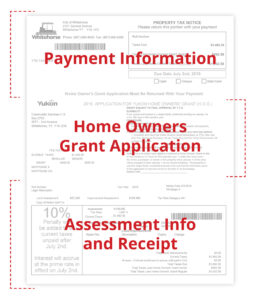

Skip the line at City Hall by remitting your payment through online banking and completing your Home Owners Grant application online!

If your mortgage company remits your property taxes on your behalf, please submit the homeowners grant application by June 10, so your mortgage company can remit your taxes, less your grant amount.

Property Taxes are due July 2, 2024. Unpaid balances on July 3 will be subject to a 10% penalty.

Credit cards cannot be accepted for property tax payments.

Unpaid 2023 utility accounts were transferred to property taxes in March 2023. Amounts over $180 (Metered/Commercial) and $350 (Flat/Residential) were transferred.

City Hall is open from 8:30 a.m. to 4:30 p.m.

I have received multiple property tax notices for the same property; have I been billed twice?

If the roll number is the same on your notices, then they’re copies of the same notice. Each owner on title is set up by default to receive a copy of the property tax notice. If you wish to change this, please email your request to [email protected].

I have received a property tax notice for a property I no longer own.

When the title of a property is transferred to a new owner, it can take up to 2-4 weeks for the City of Whitehorse to receive and process this information. Sometimes bills are generated during this window, and are mailed to the old owner. Please verify if the title has since been changed by emailing [email protected]. A copy of the title is needed to change to a new owner.

To change ownership of homes in a mobile park, fill out the Change of Mobile Home Owner form on the website. Alternatively, the buyer or seller must provide a copy of the bill of sale, or a letter from the involved lawyer stating the change of ownership. Please email to [email protected].

My property tax notice has an amount under arrears, but I paid my taxes in full last year.

If the amount is in brackets, it is a credit on your account. This usually happens due to an overpayment on your account, a grant being applied to your account, or your account is under a pre-authorized payment plan. Transaction history for property tax accounts can be found by logging into Virtual City Hall at https://vch.whitehorse.ca.

If the amount is not a credit, but you paid last year’s taxes in full, then it is likely you missed a utility account payment, which was then transferred over to your tax account. Unpaid utilities are automatically transferred to property tax accounts each year at the end of February. Transaction history for utility and property tax accounts can be found by logging into Virtual City Hall at https://vch.whitehorse.ca.

- Online Banking: Please contact your financial institution to see if they offer internet banking services. For internet banking, the payee is City of Whitehorse TAXES and the account number is your roll number. Payee names may vary depending on your financial institution. Try searching “Whitehorse” and selecting the option with “Tax(es)” in the name. We do not accept e-transfers.

- Telephone Banking: Please contact your financial institution to see if they offer telephone banking services.

- Drop Box: Place cheques in the blue Drop Box at the City Hall entrance on Second Avenue.

- In person: Front counter service open from 8:30 am to 4:30 pm. Cash, cheques and debit cards are accepted.

- Mail: Send cheques to 2121 Second Avenue, Whitehorse, YT, Y1A 1C2

Make cheques payable to the City of Whitehorse.

Do not put cash in the mail or Drop Box.

Credit cards are not accepted for Property Tax payments.

Property taxes are based on a formula that uses the assessed value provided by the Government of Yukon and mill rates established by the City of Whitehorse: Assessment x Mill Rate = Tax Levy

Mill rates are the property tax rates determined by City Council in each year’s Operating Budget. Mill rates are applied to the assessed value of a property to find the property tax levy amount. Assessment values are provided to the City of Whitehorse by the Government of Yukon’s Property Assessment and Taxation department.

2023 Mill Rate(s): Residential: 1.076 | Non-Residential: 1.628 | Agricultural: 1.146

For example, a residential property assessed at $200,000 in 2023 will have a tax levy of: 1.076% x $200,000 = $2,152.00.

Assessment values can be found on Virtual City Hall under the “Property Search” lookup.

Learn more about paying your tax bill here:

Please note Property Taxes cannot be paid with a Credit Card.

- You split your annual tax levy over 12 months from January to December;

- Taxes automatically come out of your bank account;

- You won’t get charged the 10% penalty or monthly interest for late taxes;

- If you are eligible for the Home Owners Grant (scroll down for HOG details) you can still apply at City Hall and receive the Home Owners Grant from Government of Yukon;

- We will send notifications in January of each year to let you know what your estimated tax levy is and what your monthly payments are.

- Please use this form for Pre-authorized Payments for Property Taxes

Click here for more information from Yukon Government.

Did you know? If your mortgage holder is using the Home Owners Grant towards your payment, the deadline to hand in the HOG application form is June 10, 2023.

The HOG application form is available online for those who pay taxes directly to the City.

Attention! If your taxes are being paid via pre-authorized payments, you must apply for your HOG manually using this form.

The City of Whitehorse offers a fast and convenient way to receive your utility and tax bills. With E-billing, your bills are sent directly to your email.

- It’s an environmentally-friendly option

- It avoids delivery delays

- It’s more convenient

How to enroll

Complete the enrolment/authorization form. Make sure you fill in all of your information correctly, including your email address.

For questions regarding E-billing, please call Accounts Receivable at 667-6401 or email [email protected].

- Cash, Cheque, Debit

- Credit Card (Visa or MasterCard) – except Property Taxes

- Online Banking through your bank

- For Utilities: search using Whitehorse Utility or City of Whitehorse Utility

- For Property Taxes: search using Whitehorse Tax or City of Whitehorse Tax

- We do not accept e-transfers

- Online Payment for Utilities and Other Invoices

- Pre-authorized Payment

- Bank Account for Utilities – please use this form

- To cancel pre-authorized payment for utilities, please use this form

- Please use this form for Property Taxes

- Please use this form for Other Accounts Receivable Billing

More Services

Change of Name

Did you recently change your name?

If you have an account with the City for property taxes or utilities, then you must notify the City of your new name. A change of name form is available here, and at City Hall.

Before you fill out the form, did you change your name with the Government of Yukon Land Titles Office? If you own titled property, then you have to change your name with the Land Titles Office before changing your name with the City of Whitehorse. You can find their form here.

Once you have completed your name change with the Government of Yukon, then you can submit your form along with documentation such as a copy of a marriage/divorce certificate, and a copy of your title from Land Titles to the City either in person at City Hall, or by email at [email protected].